As the national student debt rises steadily higher, Tech graduates are managing to avoid the burden of massive student loans.

CNBC recently reported that America’s student loan debt is growing at a rate of $2,853.88 per second. At this pace, it will surpass $1 trillion in 2012.

According to an online report from Mark Kantrowitz, founder of financial aid Web sites Finaid.org and Fastweb.com, the average 2011 graduate entered the job market with $27,000 of debt.

“The debt load is so crushing, many of today’s graduates will likely still be paying of their student loans when they drop their children off at their college dorm rooms,” Kantrowitz said.

In a study conducted by the U.S. Department of Education, changes made in the Higher Education Act that increased loan limits for undergraduates made borrowing large amounts of money much easier than before.

Now, regardless of their actual need for assistance, students can borrow up to $10,500 annually during their junior and senior years of college.

Crossville native Emily Corbin attended Tulane University in Louisiana, and is now facing what she describes as an insurmountable debt.

“It will be a miracle if I can pay them off,” Corbin said. “My house is worth less than I owe in student loans.”

Today’s job market offers little relief to those students with burdening debt.

Right now, there are roughly the same number of jobs in America as there were in 2000—but there are 30 million more people in the country.

The unemployment rate for college graduates one year after graduation is nearly 15 percent.

While the future may be uncertain for many of this country’s recent graduates, Director of Financial Aid Lester McKenzie said Tech graduates aren’t feeling the effects of increasing national student debt as severely as those at other universities.

The average student debt of a graduating undergraduate student at Tech is $9,510—less than half the national average.

“In college, you don’t need to live the same lifestyle you lived at home,” McKenzie said. “If you‘re borrowing money to go out to eat every night, then that’s a problem. We always preach to students to borrow only what they need.”

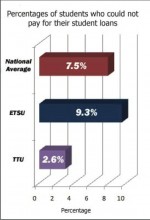

Tech’s default rate is well below the 7.5 percent national average.

Only 48 out of 1,800 borrowers defaulted on their loans last year— that’s 2.6 percent.

East Tennessee State University, a school with similar tuition rates to Tech, had a 9.3 percent default rate.

“Not only are our students borrowing less than their counterparts at other schools,” McKenzie said, “but they’re paying their loans back at a higher rate.”

McKenzie said that a big reason for the low default rate is the amount of money Tech’s new graduates are making.

“Our graduates typically have high starting salaries,” said McKenzie. “Not just our engineers, either, but our teachers and accountants, and many others.”

According to Payscale.com, Tech has the second highest starting median salary of Tennessee public universities at $42,500.

“Our students leave here and make money,” said McKenzie. “They’re paying off their student loans, which are normally low to begin with, and they’re succeeding.”